Which Best Describes What a Central Bank Uses Monetary

Which best describes what a central. It affects banks interest rates It affects banks liquidity.

Lesson Summary Monetary Policy Article Khan Academy

Learn about our Financial Review Board.

. In response to the COVID-19 pandemic central banks used an array of conventional and unconventional tools to ease monetary policy support liquidity in key. What is a potential negative effect of an expansionary policy. A key role of the central banks is to conduct monetary policy so as to achieve price stability low and stable inflation and to aid manage economic.

It is interest on money held in reserve. The _______ loan interest rate is. The opposite happens in.

It raises questions related to monetary policy central. Which statement best describes how the Feds use of open market operations affects banks. Government spending is one of the fiscal policy tools.

Central banks have four main monetary policy tools. The government uses tools such as the repo. They diverted the water to flood their enemys lands and destroy their crops.

Which statement best describes how the monetary authorities can influence the money supply. Monetary policy involves decreasing the money supply. 4 Which of the following best describes a monetary policy tool.

Storing money for banks. Use to complete a specific action. Steer the economy away from recession and toward growth.

When inflation is the Fed aims to slow the economy. Central Bank Digital Currencies CBDC is a complex and multidisciplinary topic requiring active analysis and debate. Price stability is the best contribution that monetary policy can make to economic growth.

It affects banks liquidity. Central banks use various tools to implement monetary policies. The reserve requirement open market operations the discount rate and interest.

Which best describes a central banks primary goals. Limiting inflation and reducing unemployment. D steer the economy away from recession and toward growth best describe what central bank uses money policy to do.

Central banks are typically in charge of monetary policy. Central banks do this sort of spending a part of an expansionary or easing monetary policy which brings down the interest rate in the economy. Which of these is a banking activity of the Fed.

I tax rate ii government spending iii reserve requirements iv all. The Central Bank of the United States has the primary role of Creating Monetary Policy. Which best describes what a central bank uses monetary policy to do.

We serve people living in the euro. It affects banks lending practices. How did the early egyptians use the flooding of the nile river to their advantage.

The bank within a nation is responsible for creating monetary policy. It is one of the worlds most important central banks. Three tools that are prime examples of the monetary.

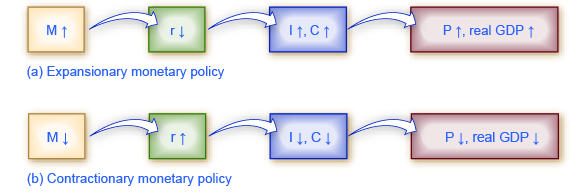

Monetary policy refers to tools used by central bank to influence economic activity. If things arent going wellunemployment is high growth is lowthen more money flowing around the economy. Central banks can change bank reserves through the sale or purchase of.

To set aside or hold for another. Why does the Fed pay interest to banks. Monetary base is the total amount of a currency that is either circulated in the hands of the public or in the commercial bank deposits held in the central banks reserves.

The Central Bank of the United States is the Federal Reserve and they create monetary. Which statement best describes monetary policy. Which best describes what a central bank uses monetary.

Central banks have four main monetary policy tools.

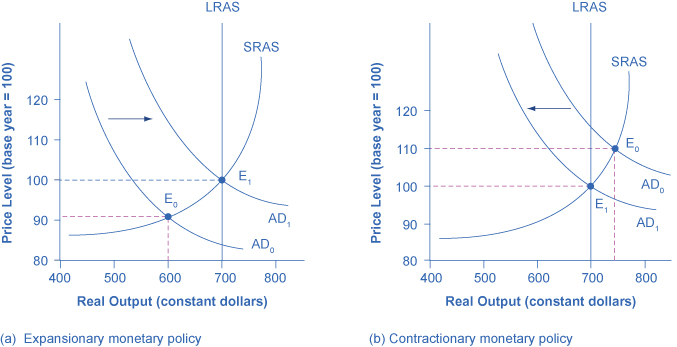

28 4 Monetary Policy And Economic Outcomes Principles Of Economics

28 4 Monetary Policy And Economic Outcomes Principles Of Economics

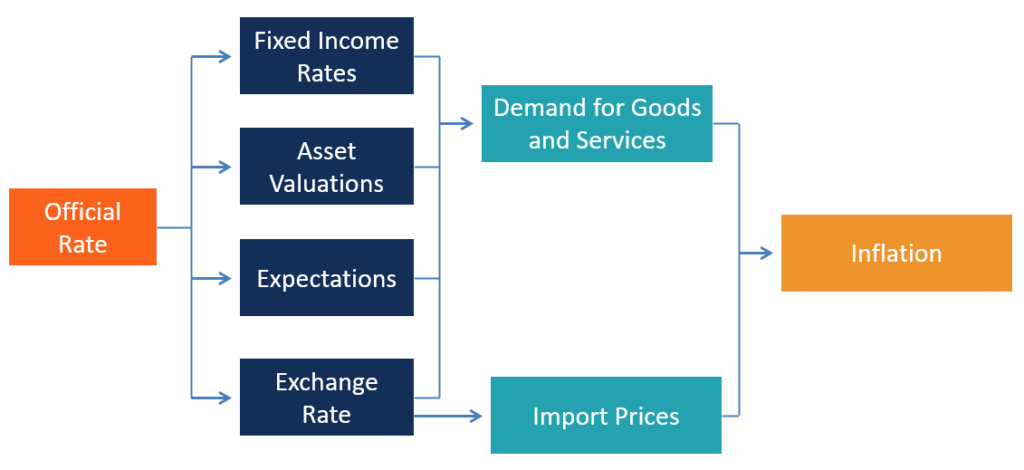

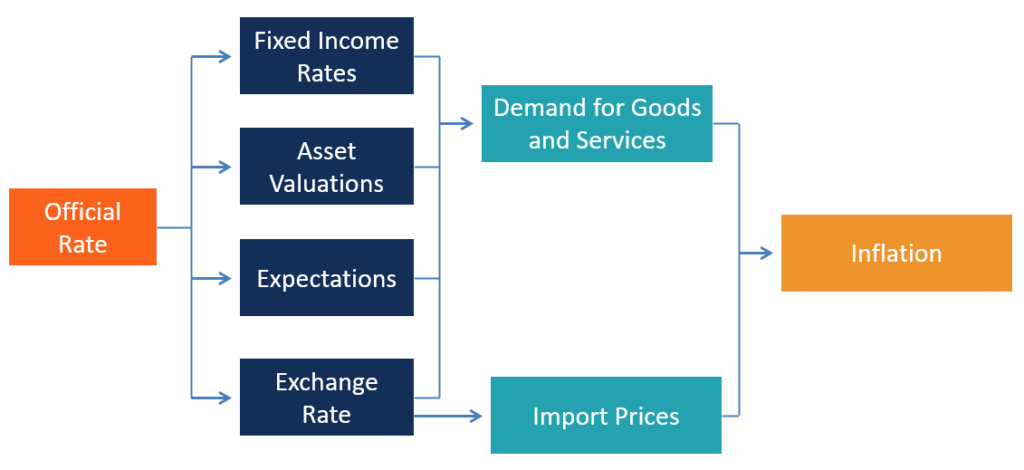

Monetary Transmission Mechanism Overview Central Bank Action

No comments for "Which Best Describes What a Central Bank Uses Monetary"

Post a Comment